Is There Sales Tax On Groceries In Washington State . retail sales tax is washington’s principal tax source. the washington state sales tax rate is 6.5%, and the average wa sales tax after local surtaxes is 8.89%. in washington state, there is a sales tax on most food items. Businesses making retail sales in washington collect sales tax from their. While washington's sales tax generally applies to most transactions, certain. However, certain food items are exempt from sales tax. are food and meals subject to sales tax? 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. this post will go over how the state of washington wants retailers to charge sales tax on groceries, drinks and prepared food. However, the law does not exempt “prepared food,” “soft. washington law exempts most grocery type food from retail sales tax.

from www.cbpp.org

this post will go over how the state of washington wants retailers to charge sales tax on groceries, drinks and prepared food. the washington state sales tax rate is 6.5%, and the average wa sales tax after local surtaxes is 8.89%. While washington's sales tax generally applies to most transactions, certain. Businesses making retail sales in washington collect sales tax from their. However, certain food items are exempt from sales tax. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. retail sales tax is washington’s principal tax source. However, the law does not exempt “prepared food,” “soft. in washington state, there is a sales tax on most food items. washington law exempts most grocery type food from retail sales tax.

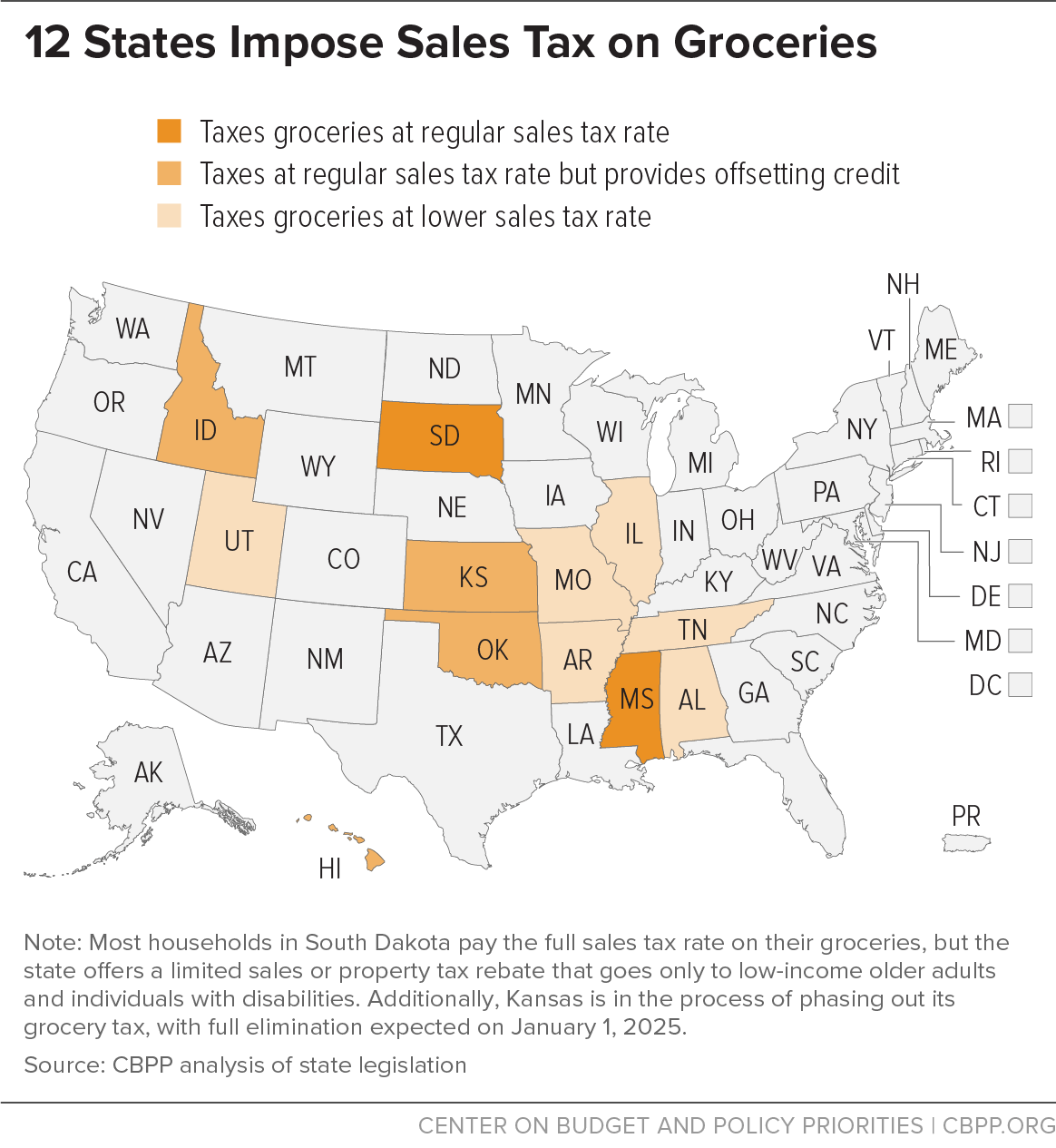

12 States Impose Sales Tax on Groceries Center on Budget and Policy Priorities

Is There Sales Tax On Groceries In Washington State Businesses making retail sales in washington collect sales tax from their. retail sales tax is washington’s principal tax source. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. washington law exempts most grocery type food from retail sales tax. the washington state sales tax rate is 6.5%, and the average wa sales tax after local surtaxes is 8.89%. in washington state, there is a sales tax on most food items. are food and meals subject to sales tax? Businesses making retail sales in washington collect sales tax from their. However, certain food items are exempt from sales tax. this post will go over how the state of washington wants retailers to charge sales tax on groceries, drinks and prepared food. While washington's sales tax generally applies to most transactions, certain. However, the law does not exempt “prepared food,” “soft.

From quizzdbbackovnc.z13.web.core.windows.net

State And Local Sales Tax Rates 2020 Is There Sales Tax On Groceries In Washington State are food and meals subject to sales tax? retail sales tax is washington’s principal tax source. However, certain food items are exempt from sales tax. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. the washington state sales tax rate is 6.5%,. Is There Sales Tax On Groceries In Washington State.

From www.icsl.edu.gr

What States Tax Groceries Is There Sales Tax On Groceries In Washington State However, the law does not exempt “prepared food,” “soft. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. in washington state, there is a sales tax on most food items. washington law exempts most grocery type food from retail sales tax. are. Is There Sales Tax On Groceries In Washington State.

From learningmacrorejs.z14.web.core.windows.net

Seattle Washington State Sales Tax Rate 2023 Is There Sales Tax On Groceries In Washington State are food and meals subject to sales tax? However, the law does not exempt “prepared food,” “soft. washington law exempts most grocery type food from retail sales tax. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. retail sales tax is washington’s. Is There Sales Tax On Groceries In Washington State.

From www.aarp.org

States With Highest and Lowest Sales Tax Rates Is There Sales Tax On Groceries In Washington State the washington state sales tax rate is 6.5%, and the average wa sales tax after local surtaxes is 8.89%. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. washington law exempts most grocery type food from retail sales tax. are food and. Is There Sales Tax On Groceries In Washington State.

From www.cbpp.org

States That Still Impose Sales Taxes on Groceries Should Consider Reducing or Eliminating Them Is There Sales Tax On Groceries In Washington State washington law exempts most grocery type food from retail sales tax. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. Businesses making retail sales in washington collect sales tax from their. While washington's sales tax generally applies to most transactions, certain. are food. Is There Sales Tax On Groceries In Washington State.

From topforeignstocks.com

Sales Tax on Grocery Items by State Chart Is There Sales Tax On Groceries In Washington State the washington state sales tax rate is 6.5%, and the average wa sales tax after local surtaxes is 8.89%. However, the law does not exempt “prepared food,” “soft. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. However, certain food items are exempt from. Is There Sales Tax On Groceries In Washington State.

From statesalestaxtobitomo.blogspot.com

State Sales Tax Washington State Sales Tax King County Is There Sales Tax On Groceries In Washington State this post will go over how the state of washington wants retailers to charge sales tax on groceries, drinks and prepared food. washington law exempts most grocery type food from retail sales tax. However, certain food items are exempt from sales tax. However, the law does not exempt “prepared food,” “soft. While washington's sales tax generally applies to. Is There Sales Tax On Groceries In Washington State.

From www.gobankingrates.com

Sales Tax by State Here's How Much You're Really Paying GOBankingRates Is There Sales Tax On Groceries In Washington State 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. While washington's sales tax generally applies to most transactions, certain. Businesses making retail sales in washington collect sales tax from their. washington law exempts most grocery type food from retail sales tax. However, certain food. Is There Sales Tax On Groceries In Washington State.

From ezylearn.com.au

Sales Tax Simplified With Xero's TaxJar Integration EzyLearn Pty Ltd Is There Sales Tax On Groceries In Washington State However, certain food items are exempt from sales tax. are food and meals subject to sales tax? in washington state, there is a sales tax on most food items. However, the law does not exempt “prepared food,” “soft. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales. Is There Sales Tax On Groceries In Washington State.

From zamp.com

Sales Tax on Groceries by State Is There Sales Tax On Groceries In Washington State are food and meals subject to sales tax? in washington state, there is a sales tax on most food items. However, the law does not exempt “prepared food,” “soft. retail sales tax is washington’s principal tax source. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales. Is There Sales Tax On Groceries In Washington State.

From opportunitywa.org

Washington ranks 2nd in the nation for per capital sales tax collections Tax Foundation Is There Sales Tax On Groceries In Washington State While washington's sales tax generally applies to most transactions, certain. this post will go over how the state of washington wants retailers to charge sales tax on groceries, drinks and prepared food. in washington state, there is a sales tax on most food items. However, the law does not exempt “prepared food,” “soft. washington law exempts most. Is There Sales Tax On Groceries In Washington State.

From zamp.com

Sales Tax on Groceries by State Is There Sales Tax On Groceries In Washington State retail sales tax is washington’s principal tax source. However, certain food items are exempt from sales tax. this post will go over how the state of washington wants retailers to charge sales tax on groceries, drinks and prepared food. While washington's sales tax generally applies to most transactions, certain. However, the law does not exempt “prepared food,” “soft.. Is There Sales Tax On Groceries In Washington State.

From statesalestaxtobitomo.blogspot.com

State Sales Tax State Sales Tax Deduction Washington Is There Sales Tax On Groceries In Washington State this post will go over how the state of washington wants retailers to charge sales tax on groceries, drinks and prepared food. washington law exempts most grocery type food from retail sales tax. However, certain food items are exempt from sales tax. are food and meals subject to sales tax? the washington state sales tax rate. Is There Sales Tax On Groceries In Washington State.

From www.pinterest.com

sales tax calculator for Washington state Tax, Sales tax, Photography business Is There Sales Tax On Groceries In Washington State Businesses making retail sales in washington collect sales tax from their. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. However, certain food items are exempt from sales tax. the washington state sales tax rate is 6.5%, and the average wa sales tax after. Is There Sales Tax On Groceries In Washington State.

From kgmi.com

Washington ranks highest in nation for reliance on sales tax 790 KGMI Is There Sales Tax On Groceries In Washington State are food and meals subject to sales tax? 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. However, the law does not exempt “prepared food,” “soft. retail sales tax is washington’s principal tax source. in washington state, there is a sales tax. Is There Sales Tax On Groceries In Washington State.

From zamp.com

Ultimate Washington Sales Tax Guide Zamp Is There Sales Tax On Groceries In Washington State 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. retail sales tax is washington’s principal tax source. washington law exempts most grocery type food from retail sales tax. this post will go over how the state of washington wants retailers to charge. Is There Sales Tax On Groceries In Washington State.

From ygacpa.com

What is Washington State Sales Tax? Is There Sales Tax On Groceries In Washington State However, the law does not exempt “prepared food,” “soft. this post will go over how the state of washington wants retailers to charge sales tax on groceries, drinks and prepared food. washington law exempts most grocery type food from retail sales tax. While washington's sales tax generally applies to most transactions, certain. retail sales tax is washington’s. Is There Sales Tax On Groceries In Washington State.

From housedemocrats.wa.gov

The truth about taxes in Washington Washington State House Democrats Is There Sales Tax On Groceries In Washington State are food and meals subject to sales tax? this post will go over how the state of washington wants retailers to charge sales tax on groceries, drinks and prepared food. washington law exempts most grocery type food from retail sales tax. the washington state sales tax rate is 6.5%, and the average wa sales tax after. Is There Sales Tax On Groceries In Washington State.